Financial services lead generation succeeds when precision, compliance, and human trust work together to attract high value investment and banking clients.

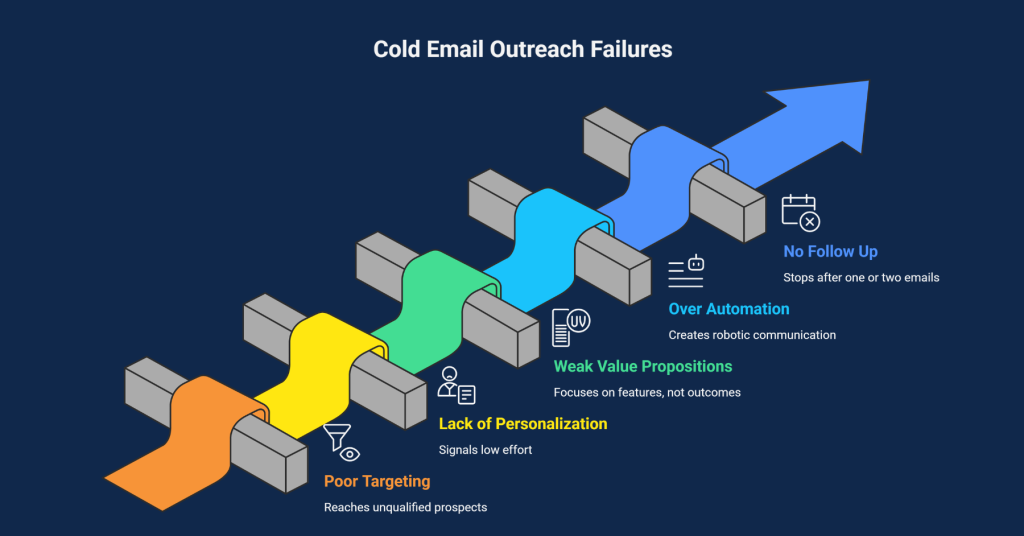

Financial services firms face a unique challenge when it comes to growth. Unlike many industries, success is not driven by volume alone. Trust, compliance, and timing play a critical role in converting prospects into long term clients. Many banks, investment firms, and financial advisors struggle with inconsistent pipelines because their lead generation strategies focus on reach rather than relevance.

Financial services lead generation must be precise, compliant, and relationship driven. Decision makers want conversations that demonstrate understanding of risk, regulation, and financial goals. Generic outreach and automated campaigns often fail to build credibility or attract qualified investment clients.

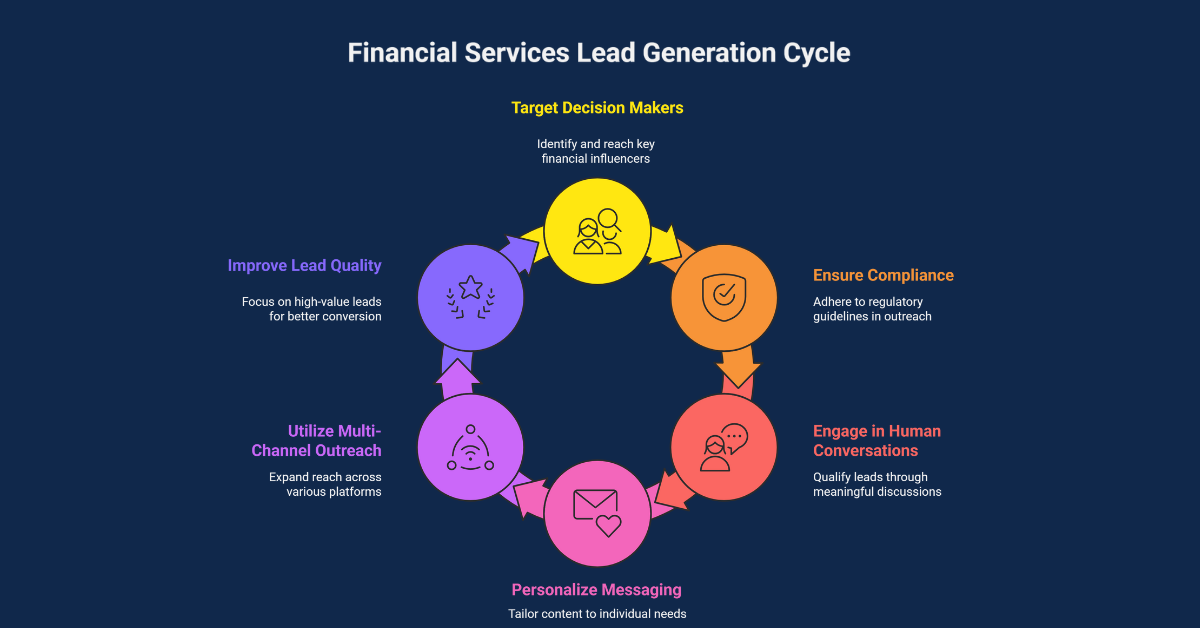

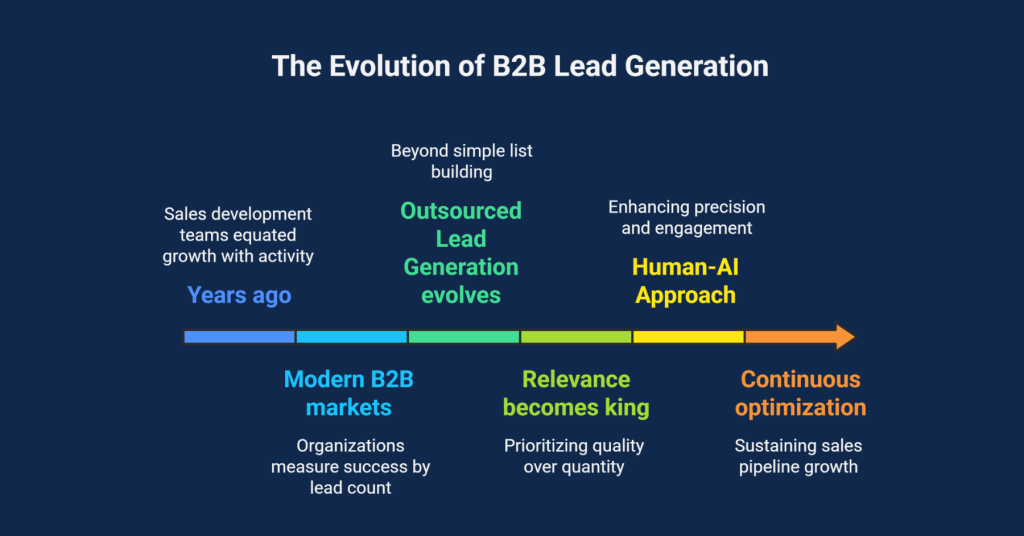

This is where a structured, Human AI driven approach becomes essential. By combining intelligent data insights with experienced human engagement, financial services firms can attract higher quality leads and convert them into revenue generating relationships. Below are six proven ways modern financial services lead generation delivers consistent results.

1. Targeting the Right Financial Decision Makers

Financial services lead generation starts with accurate targeting. Reaching the wrong audience wastes time and damages brand credibility. Many campaigns fail because they rely on broad demographics rather than role specific and intent based data.

Effective targeting focuses on decision makers who influence investment, banking, or financial strategy. This includes CFOs, finance directors, wealth managers, and institutional buyers. Using refined data ensures outreach reaches prospects with real buying authority.

A Human AI approach improves targeting by combining data intelligence with human validation. This reduces noise and increases the likelihood of meaningful conversations.

2. Compliance Safe Outreach Builds Trust Early

Compliance is non negotiable in financial services. Outreach that ignores regulatory requirements risks reputational damage and lost opportunities. Prospects are quick to disengage if messaging feels aggressive or non compliant.

Successful financial services lead generation follows strict compliance guidelines across email, phone, and digital channels. Messaging is carefully structured to educate rather than pressure. Transparency builds credibility from the first interaction.

Human led outreach ensures tone and messaging align with regulatory expectations. This trust driven approach improves response rates and long term engagement.

3. Human Conversations Qualify Investment Intent

Automated outreach can generate responses, but it struggles to assess true intent. Financial decisions involve complexity, risk tolerance, and long term planning. These factors require conversation, not automation.

Human SDRs engage prospects in meaningful discussions to understand goals, timelines, and constraints. This qualification ensures only serious investment clients move forward.

By combining AI insights with human conversation, financial services lead generation filters out low intent prospects while prioritizing high value opportunities.

4. Personalized Messaging Improves Engagement Rates

Financial buyers expect relevance. Generic messages fail to address specific financial needs, market conditions, or investment objectives. Personalization is critical for engagement.

Human AI driven campaigns tailor messaging based on industry, role, and financial focus. This includes referencing market trends, regulatory changes, or portfolio goals.

Personalized outreach positions your firm as informed and credible. This increases meeting acceptance and strengthens initial conversations.

5. Multi Channel Outreach Expands Reach Without Fatigue

Relying on a single channel limits exposure. Financial services prospects engage across multiple platforms including email, phone, and professional networks.

A multi channel strategy ensures consistent visibility without overwhelming prospects. Timing and sequencing are carefully managed to maintain professionalism.

Human oversight ensures outreach remains respectful and relevant. This balanced approach increases response rates while protecting brand reputation.

6. Better Lead Quality Improves Long Term Client Value

High quality financial services leads convert at higher rates and stay longer. Focusing on quality rather than volume reduces churn and improves lifetime value.

Qualified banking sales leads and investment clients are more likely to progress through the pipeline. Sales teams spend less time on unqualified conversations. Financial services lead generation that prioritizes quality delivers stronger pipelines and predictable growth.

Services Provided by Salaria Sales

Salaria Sales helps financial services firms generate qualified leads through a proven Human AI driven model. As a Full-Service B2B Sales & SDR Outsourcing Agency, we specialize in building compliant, high quality pipelines for banks, investment firms, and financial service providers.

Our approach combines advanced data intelligence with experienced human SDRs. AI supports account research, intent identification, and prioritization. Human SDRs lead outreach, qualification, and relationship building. This ensures every conversation is relevant, compliant, and sales ready.

We manage the entire lead generation process end to end. This includes ICP development, multichannel outreach, compliance safe messaging, qualification frameworks, and CRM reporting. Financial services firms gain full visibility into performance and pipeline impact.

Salaria Sales focuses on quality over volume. Our Human AI approach consistently delivers financial services leads that convert into long term clients.

Conclusion

Financial services lead generation requires more than automation and scale. Trust, compliance, and relevance determine success. Firms that rely solely on volume driven outreach struggle to convert prospects into meaningful client relationships.

By combining AI intelligence with human expertise, financial services firms can attract the right investment clients and banking sales leads. Human led conversations ensure proper qualification while AI enhances efficiency and focus.

This balanced approach creates stronger pipelines, higher conversion rates, and sustainable growth. Financial services organizations that invest in quality driven lead generation outperform those chasing volume alone.

The future of financial services growth belongs to firms that prioritize precision, compliance, and human connection.

Frequently Asked Questions

What is financial services lead generation?

Financial services lead generation focuses on attracting qualified prospects for banking, investment, and financial advisory services through targeted outreach.

Why is compliance important in financial lead generation?

Compliance protects brand credibility and ensures outreach meets regulatory standards, which is critical for trust and engagement.

How does Human AI improve lead quality?

AI improves targeting and prioritization, while humans handle qualification and conversations, resulting in higher quality leads.

What types of firms benefit most from financial services lead generation?

Banks, investment firms, wealth managers, and financial service providers benefit most from structured lead generation.

Does Salaria Sales handle compliance requirements?

Yes. Salaria Sales ensures all outreach aligns with compliance standards and best practices.